The following is a list of the most important changes to the PIA software since 2004.

Changes to PIAPro, PIAFpu 8.1.07 (25-Jul-2023)

- Fixed an report issue with tax benefits and multiple properties

- Fixed an issue with a row title in the Linked Loan spreadsheet (Total repayments)

- Changes to tax status of Holding costs in house/land packages. Holding costs for the land remain a capital cost whereas

the interest costs associated with the construction of the building may be considered by the ATO as a revenue cost

(See

TR 2021/D5, para 27).

- Changes to stamp duty scales for NSW

- Changes to land tax scales for NSW, Vic, SA, ACT, Tas

- Changes to fees for Title and Mortgage registration in all States and NZ

- Fixed an issue with the living expenses list control when accessing the Home Loan dialog

- Updated defaults for effective life of depreciable assets (following a 2022 review)

- Fixed an issue with respect to retaining the default Australian State

Changes to PIAPro, PIAFpu 8.1.06 (27-Sep-2022)

- Fixed an issue with exporting spreadsheets

- Fixed an issue with client name initialisation (PIAFpu)

Changes to PIAPro, PIAFpu 8.1.05 (03-Aug-2022)

- Changes to Australian Tax scales (LAMITO removed. LITO retained)

- Changes to stamp duty scales for NSW

- Changes to land tax scales for NSW, Vic, SA, Tas

- Changes to fees for Title and Mortgage registration in all States and NZ

- Fixed an issue with a checkbox in the SMSF Options dialog

- Added the option for specifying the year of construction independent of the first year of projections

(This will restrict the number of years for which building depreciation (capital allowance) is claimed).

Changes to PIAPro 8.1.04 (23-May-2022)

- Changes to Australian Tax scales (LAMITO)

- Changes to stamp duty scales for NSW

- Fixed potential issue with report templates

- Improved pdf file format for reports

Changes to PIAPro 8.1.02 (26-Dec-2021)

- Changes to stamp duty scales for NSW,

Vic

- Changes to land tax scales for NSW, SA,

Tas and ACT

- Changes to mortgage registration fees

for all Australian States

- Changes to land transfer fees in all

Australian States

- Cosmetic updates including coloured

theme options for main window

- The user interface is now optimised for

high resolution displays

- Fixed an issue with Borrowing Capcity

calculator to enable saving changes

Changes to PIAPro, PIAFpu 8.0.21 (13-Apr-2021)

- Fixed an issue with automatic update checks

Changes to PIAPro, PIAFpu 8.0.20 (02-Apr-2021)

- Added the option of making interest non-deductible (NZ default)

- Changes to the NZ Tax Scales

- Minor change to the Detailed report

Changes to PIAPro, PIAFpu 8.0.10 (18-Oct-2020)

- Changes to the NZ Tax Scale, making quarantining of losses ("ring-fencing") the default

- Changes to Australian Tax Scales, including Low Income Tax Offset

- Changes to default Stamp Duty scales in NSW

- Changes to default Land Tax scales in NSW, ACT and SA

- Changes to default transfer of title and mortgage registration fees in most States

- Added File Export option for saving spreadsheets and related variables

into a tab delineated format that can be read into Excel

- Added an option for an additional set of country defaults (eg USA)

- Changes to Borrowing Capacity calculator to accommodate portfolios

- Changes to the Wealth Builder spreadsheet, now displaying the after-tax cash flow

- Added Loan Repayments graphic option to customised report

- Wealth Builder graphic now portrays Net Worth as well as Investment equity

Changes to PIAPro, PIAFpu 7.5.50 (31-Jul-2019)

- Changes to Australian Tax Scales (Low and Middle Income-Earner Tax Offset)

- Changes to default Stamp Duty scales in NSW, ACT

- Changes to default Land Tax scales in NSW, ACT and SA

- Changes to default transfer of title and mortgage registration fees in all States

- Allowed default registration fees to be user-changeable

- Further changes to Report Summary when there is variation in rate parameters (interest, inflation, growth)

- Changes to Borrowing Capacity calculator to accommodate portfolios

- Cosmetic changes to various reports

Changes to PIAPro, PIAFpu 7.5.41 (14-Sep-2018)

- Fixed an issue with SMSF and Company investor types (inadvertently introduced in 7.5.40)

- Update to default NRAS entitlements

- Cosmetic change to report header for spreadsheets

Changes to PIAPro, PIAFpu 7.5.40 (30-Jul-2018)

- Changes to Australian Tax Scales including the addition of the Low and Middle Income-Earner Tax Offset

- Changes to default Stamp Duty scales (ACT).

- Changes to default Land Tax scales in Qld, NSW, WA, ACT and SA

- Cosmetic changes to Report Summary when there is variation in rate parameters (interest, inflation, growth)

- Fixed an issue with the default value for the ACC Earners levy threshold (NZ)

- Fixed an issue in the Portfolio report (Cumulative Investment) when properties are included that were purchased before the base year

Changes to PIAPro, PIAFpu 7.5.35 (29-Nov-2017)

-

Refinements to the Portfolio Analysis for dealing with properties purchased in the future

-

Refinements to the Wealth Builder to cater for Portfolios containing properties

purchased in the future.

Changes to PIAPro, PIAFpu 7.5.33 (16-Oct-2017)

-

Added more flexibility in linking value of depreciable fittings with property price

-

Principal loan payments now accounted for in Who Pays graphic

Changes to PIAPro, PIAFpu 7.5.32 (10-Oct-2017)

-

Refinement of Wealth Builder credit line options

Changes to PIAPro, PIAFpu 7.5.30 (19-Sep-2017)

-

Changes to default Australian tax scales.

Removal of the 2% temporary budget repair levy and a reduction in the company tax rate.

The Medicare levy is to be increased from 2% to 2.5% in July 2019 and has not been changed in PIA in this version.

- Change to the NZ ACC Earners levy

- Changes to default land tax scales in NSW, ACT and SA

- Changes to default stamp duty scales in ACT and NT

-

Changes to the Registration of title

In past years, this has mostly been a small fixed charge by State Governments to

cover the administrative cost of transferring the title registration to the new owner.

It may well have been paid for by your solicitor and appeared in your conveyancing costs.

However in recent years some State Governments have seen fit to significantly increase the

fees for performing this service and the amount charged can even be a function of the property price.

As such, the item is now identified in PIA as a separate Purchase cost and the default values

are based on the State and, where appropriate, property price.

- Fixed a problem associated with very large image files

-

Added additional options to the Wealth Builder credit line model

The Wealth Builder has always provided the opportunity to collate home and investment property

cash flows and assets over a 40-year projection time line. Choosing a Credit Line model

in this spreadsheet implies using any cash surplus to repay debt, firstly off the home loan and then

off any investment loans. By default, this assumes that all loan committments become interest-only and

any cash deposits and principal payments form part of the available cash. The latest version of PIA now has

the option to vary this default behaviour and retain the commitment to cash deposits and principal payments

on the investment loans.

-

Changed defaults for Fittings depreciation (Australia only)

In the most recent Federal budget (9 May, 2017), it was proposed that the depreciation of plant and equipment

(fixtures and fittings) would only be on that which is actually purchased (i.e. you cannot depreciate fixtures and fittings

purchased by a previous owner, even with a quantity surveyor’s report). Thus the new default for PIA is that the

value of fixtures and fittings is zero though you can still add items that you purchase new. For new properties, the value of

fixtures and fittings is usually available in the form of a Quantity Surveyor's report from the builder or developer and

these figures are most easily transferred to PIA as the annual depreciation claims.

Investors who purchase new plant and equipment for their residential investment property after 9 May 2017 will be

able to claim a deduction over the effective life of the asset. However, subsequent owners of a property will be

unable to claim deductions for plant and equipment purchased by a previous owner of that property.

Plant and equipment forming part of residential investment properties as of 9 May 2017 (including contracts already

entered into at 7:30 pm (AEST) on 9 May 2017) will continue to give rise to deductions for depreciation until either

the investor no longer owns the asset, or the asset reaches the end of its effective life.

-

Other changes to property-related tax laws (Australia only)

There were other measures featured in the May, 2017 Federal budget that are worth mentioning, even though there are no

corresponding changes to the PIA default settings.

- Travel expenses related to inspecting, maintaining or collecting rent for a residential rental property will be

disallowed from 1 July 2017.

- An increased CGT discount for investments in affordable housing.

From 1 January 2018 the CGT discount for individuals will be increased from

50% to 60% for gains relating to investments in what qualifies as affordable housing.

- A number of changes that affect foreign investors in terms of CGT and annual charges

where residential property is underutilised (i.e. not available for at least six months of the year).

These are in additional to the higher stamp duty and land tax charges for foreign investors by various State Governments.

Changes to PIAPro, PIAFpu 7.5.20 (11-Aug-2016)

- Changes to default Australian tax scales

- Changes to default land tax scales in NSW, ACT and SA (see below)

- Change to default stamp duty scales in ACT (see below)

- Fixed a problem with Fittings/Chattels naming in depreciation template

- Cosmetic change to the Loan costs dialog when loan costs are paid in cash

- Direct changes to annual rent can now be made in any year

- Fixed an issue with the Cumulative Tax Liabilities graphic/report when partner included

- PIAPro default disclaimer has additional text to cover the provision of general information

- PIAPro standard Investment Analysis reports now exclude Investment Capacity component (still available in Customised Report)

- It is now possible to reset all settings to the program's original defaults.

- Changes to the default font selection

Changes to PIAPro, PIAFpu 7.5.15 (10-Jul-2015)

- Changes to Land tax scales in NSW, ACT and WA

- Change to stamp duty scales in ACT

- Update to the default NRAS tax incentive

- Cosmetic change to the integrated Help

- Change to initial NZ settings

Changes to PIAPro, PIAFpu 7.5.12 (16-Dec-2014)

- Cosmetic change to spreadsheet when projections restricted to one year only

- Fixed an issue with stamp duty calculated on land only

- Change to stamp duty scale for ACT

- Cosmetic changes for dealing with properties 100% in partners name

- Cosmetic change to reports regarding NANE income and NRAS

Changes to PIAPro, PIAFpu 7.5.10 (31-Jul-2014)

- Changes to stamp duty scales for ACT and Tasmania

- Changes to land tax scales in NSW, ACT and WA

- Changes to Australian tax scales and medicare levy

- Incorporation of ACC Earner's levy in New Zealand tax scale

- NRAS: Update to default annual subsidy

- NRAS: Changes to tax treatment of compliance costs

- NRAS: Rental expenses apportioned to NANE income (State contribution) are now incorporated in the cost base for CGT calclulations

- Additional page added to the Who Pays report (cumulative income and expenses)

Changes to PIAPro, PIAFpu 7.5.04 (11-Dec-2013)

- Update to Qld stamp duty scale

- Update to WA Land tax scale

- Easy access to PIA Quick Start Guide, PIA User Guide and PIA FAQ's (Help menu)

- Option to check for program updates (Help menu)

Changes to PIAPro, PIAFpu 7.5.03 (30-Jul-2013)

- Update to ACT stamp duty scale

- Revised the program behaviour for displaying Annual Cash Surplus as the spreadsheet bottom line

- Fixed an issue with the display of tax credit calculations in the Cash Flow report

Changes to PIAPro, PIAFpu 7.5.02 (16-May-2013)

- Update to default annual NRAS subsidy

- Update to NSW Land tax threshold

- Minor changes to various reports

- Cosmetic change to Report menu

Changes to PIAPro, PIAFpu 7.5.01 (24-Apr-2013)

- Added Super Fund (SMSF) and Company as well as Person(s) as investor types (Investor details dialog) to make it a much simpler process for analysing property investment through other entities.

- Added an SMSF Options dialog (Settings menu) for managing the various variables associated with property investment through a self-managed superannuation fund. These include variables that apply when an SMSF is in pension phase.

- Revised the NRAS Options dialog (Settings menu) to make it easier to compare the cash flow on similar NRAS and non-NRAS properties.

- Added an NRAS Tax Incentive dialog (under NRAS Options dialog) to enable apportionment of tax deductions to account for non-assessable non-exempt (NANE) income.

- Fixed an issue with the Credit Line model in the Wealth Builder when dealing with existing portfolios that include properties that had also been financed under credit lines.

- Fixed an issue with automatic recalculation of building depreciation when dealing with a house and land package.

- Added several new worked examples to the Tutorial section of the integrated Help file (Help menu/Help Topics) to cover the use of an SMSF, NRAS properties, house and land packages, accelerated home loan repayment and the use of the Linked Loan spreadsheet.

- Fixed an issue with correct indexing of NRAS tax credits under a credit line model

- Fixed the graphical display of Who Pays in a pdf report when its 100% tenant.

- Fixed the model behaviour when using a credit line under a linked loan (Settings menu/Linked Loan Options)

Changes to PIAPro, PIAFpu 7.3.50 (29 Aug 2012)

- Changes to stamp duty and land tax scales in the ACT

- Changes to stamp duty scales in Qld

- Fixed an issue with the collation of future portfolios and their application in the Wealth Builder

Changes to PIAPro, PIAFpu 7.3.45 (21 May 2012)

- Australian tax scales updated (removal of flood levy, changes to low income tax threshold rules, etc)

- Changes to stamp duty scales (Tas)

- Changes to Land Tax threshold (NSW)

- Update to default NRAS tax credit

- Fixed an issue with printing/pagination with certain fonts and program options

- Added an option for including additional notes in property description in reports

Changes to PIAPro, PIAFpu 7.3.40 (20 Jan 2012)

- Added tax scale options for self-managed super funds and companies

- Added an option to display the annual cash surplus as the bottom line in the Investment Analysis spreadsheet

- Added an associated dialog for when the annual cash surplus is displayed (clicking on the figures in the spreadsheet shows their derivation in a pop-up dialog)

- Added associated dialogs for rental income and expenses in the Wealth Builder

- Fixed an issue in the NRAS options dialog where year 10 rents displayed incorrectly when NRAS had already been set

- Fixed an issue of conventions in displaying Cost/(Income) per Week in the Investment Analysis reports when cash flow is negative

- Added an option in the Property Value dialog for calculating stamp duty on land price only (applicable in house & land package investments)

- Changed the behaviour for projecting property values when the projected property value is over-written

- By default, when NRAS is selected, the rental agents commission is now calculated as a percentage of the market rent rather than the discounted rent.

Changes to PIAPro, PIAFpu 7.3.35 (30 Aug 2011)

- Fixed an issue with capitalised interest in a portfolio

- Changes to NRAS defaults

- More changes to Land Tax scales in NSW and SA.

- First year expenses now always integrated with Rental Expenses

template, irrespective of whether annual expenses are set for indexing

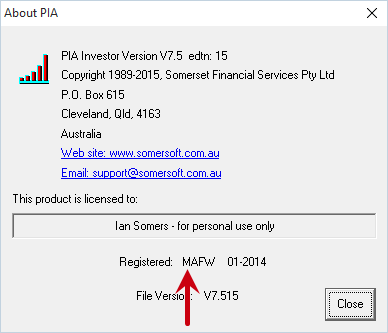

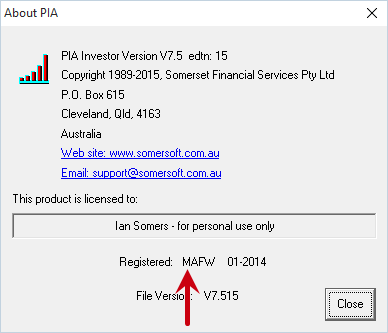

- Current file version (as opposed to Program version) also displayed

in About PIA dialog

- Updates to PIA Quick Start Guide and integrated PIA Help examples,

using latest tax and stamp duty scales

Changes to PIAPro, PIAFpu 7.3.30 (08 Jul 2011)

- Changes to Australian tax scales to accommodate the Flood Levy

- Changes to stamp duty scales in Queensland and Northern Territory

- Changes to Land Tax scales in NSW and SA.

- Depreciation detail added to Cash Flow report

Changes to PIAPro, PIAFpu 7.3.22 (12 Nov 2010)

- Fixed a problem with page offsets in report files (pdf format).

- Changes to the Tax Variation analysis under NRAS (excludes NRAS tax credits)

- Fixed a problem to ensure manual changes to Low Income Tax Offset parameters are saved

- Cosmetic changes to correct "Total Deduction" title in the Personal details dialog

- Changes to the program to make it more compatible with Macintosh computers under Codeweavers Crossover for Mac

To run PIA (or any other Windows program) on a new Macintosh, we recommend a simple inexpensive system called CrossOver by CodeWeavers which is built on a technology called WINE. It does not require a copy of Windows and our tests so far have all proven to work perfectly.

Codeweavers are offering a 20% discount to PIA owners. You can trial it before you buy it and the cost

is (I think) very reasonable (< US$40).

For PIAFpu the link is... http://www.codeweavers.com/via/piafpu

For PIAPro the link is... http://www.codeweavers.com/via/piapro

Changes to PIAPro, PIAFpu 7.3.20 (27 July 2010)

- Changes to Australian Tax Scales, including the Medicare levy and Low Income Tax Offset.

- Changes to New Zealand Tax Scales.

- Changes to Land Tax Scales in Qld, NSW, SA and Tas.

- Changes to New Zealand building and chattels depreciation rates.

- Additional options for the Linked Loan model

- Update to NRAS defaults and additional NRAS labelling in reports

- Clarification of option for quarantining tax losses.

- Updates to Help documentation, Quick Start Guide and User Guide

Changes to PIAPro, PIAFpu 7.3.01 (29 November 2009)

- Correction to facilitate the printing of a specified page range of a report

- Changes to allow individual changes to NRAS settings

Changes to PIAPro, PIAFpu 7.2.50 (25 June 2009)

- Changes to Australian tax scales including the incorporation of the Low Income Tax Offset

- Changes to Land tax scales for NSW & WA

- Changes to Investment Capacity dialog & report to better reflect the earlier change allowing an apportionment of rental deductions for private use

Changes to PIAPro, PIAFpu 7.2.41 (18 May 2009)

- Enabled National Rental Affordability Scheme option to apply to multiple properties

Changes to PIAPro, PIAFpu 7.2.40 (27 April 2009)

- Update to New Zealand tax scale

- New feature to model impact of National Rental Affordability Scheme (Australia)

- Added ability to apportion percentage of investment expenses to private use

- Full Investment Capacity report now available when accessed from Wealth Builder

- Portfolio report also now available when accessed from Wealth Builder

- Years displayed in spreadsheets are always reflected in reports, even when blank.

Changes in PIAPro, PIAFpu, 7.2.36 (10-Jul-08)

- Update to Australian tax scale

- Updated PIA Quick Start Guide (pdf version)

Changes in PIAPro, PIAFpu, 7.2.35 (10-Jun-08)

- Changes to Australian & NZ tax scales

- Changes to Stamp duty scales in Qld, Vic, WA & NT

- Changes to Land tax scales in Qld, Vic & WA

- Changes to program defaults to better reflect changes in current

financial environment

- Additional graphic report (Graphic menu) showing weekly averages for

net costs compared to equity growth over the projected period for the

investment

- Fixed an issue with the display of Home Loan term in the Wealth

Builder spreadsheet under certain conditions

Changes in PIAPro, PIAFpu, 7.2.32 (04-Mar-08)

- Fixed an issue where no printer is installed

- Changes to land tax threshold in NSW

Changes in PIAPro, PIAFpu, 7.2.30 (12-Dec-07)

- Addition of a Holding costs variable (most applicable in house and land packages)

- Currency symbol option (most applicable in UK and European applications)

- CGT calculations now accommodate the situation where tax losses are carried forward

Changes in PIAPro, PIAFpu, 7.2.25 (11-Sep-07) and PIAPkt 1.020 (11-Sep-06)

- Changes to land tax scales NSW, Vic & WA, & stamp duties in Qld

- Changes to NZ defaults for depreciation rates

- Fixed an issue with displaying both logo and property image in pdf

reports (PIAPro)

- Reformat of Current Taxable Income dialog and data entry for

existing portfolio

- Remaining home loan term now displayed in Wealth Builder

- Reformat of Help files for compatibility with Vista O/S

- Updated PIA Quick Start Guide

- Updated PIA User's Guide

- Added scrolling to main screen to accommodate small-screen devices (PIAPkt)

Changes in PIAPro, PIAFpu, 7.2.21 (02-Jul-07)

- Changes to default Australian tax scales.

- Changes to NSW land tax calculator.

- Minor change to portfolio creation procedure.

Changes in PIAPro, PIAFpu 7.2.20 (08-Mar-07)

- Added a split-rate loan facility under loan types (Interest and Loan

Type dialog). This change has been made in response to a relatively new

loan product in which a portion of the interest is capitalised in the

first few years and the remaining portion paid as interest only.

- Cosmetic changes to some report formatting (Cash flow, Rate of Return, Investment Loan Payments).

- Added Internal Rate of Return (if sold) as a bottom line option for Investment Analysis spreadsheet(Settings/menuPreferences) and

to the body of the related reports.

- Changed starting years shown on input dialogs to be a chronological sequence (1,2,3,4,5) rather than as the sequence shown on the related spreadsheet.

- Fixed the Help reference from the Interest rate button in the Home Loan Analysis spreadsheet

Changes in PIAPro, PIAFpu, 7.2.11 (29-June-06)

- Changes to depreciation rates under effective life rules (Australia).

- Changes to Land Tax thresholds and scales (Qld, NSW, Vic, WA)

- Fix to home loan payments

- Updated Quick Start Guide & PIA Help documentation

- Fix to changing variables from Report view

Changes in PIAPro, PIAFpu, 7.2.08 (16-May-06) and PIAPkt 1.019 (06-Jun-06)

- Updated tax scales (from 2006/07 financial year).

- Changes to Qld Stamp Duty scales (from 2006/07 financial year)

Changes in PIAPro, PIAFpu, 7.2.07 (21-Feb-06)

- Fix to Multiple Properties report (Investment Capacity / Full Report).

Changes in PIAPkt 1.018 (06-Dec-05)

Changes in PIAPro, PIAFpu, 7.2.06 (13-Sep-05)

- Minor fix to Cash Flow Analysis report (if marginal tax rate is chosen to calculate tax credits).

- Minor fix to Custom Report (if Rate of Return report is included).

Changes in PIAPro, PIAFpu, 7.2.05 (16-Jun-05)

- Tax scales (Australia) changed for 2005/06.

- Land tax scales changed for Qld, Vic, SA, WA, ACT, Tas

- Changes to building depreciation rates (NZ)

Changes in PIAPro, PIAFpu, 7.2.03 (28-Apr-05)

- W.A. stamp duty scales have been updated (they have actually been reduced!)

- Minor formatting changes to Descriptive Investment Report (holiday letting)

- Changes to Who Pays graphic report in relation to capitalised interest and expenses

Changes in PIAPro, PIAFpu, 7.2.02 (24-Feb-05)

- A company logo can now be inserted into report

headings (PIAPro only)

- Refinements to portfolio collation for various

loan types

- Changes to calculation of break-even parameters

under a P&I loan

Changes in PIAPro, PIAFpu, 7.2.01 (15-Dec-04)

- Undo/Redo facility has been added

- Photographs can be loaded into the interface and used in reports

- A personally customised report has now been added

- Reports can now be saved or emailed in Adobe Acrobat (pdf) format

- A land tax calculator (to cover all Australian States) has been added

- More analytical information is now made available (e.g. initial

investment required to break-even in first year; years required to

break-even, gross & net yield, cash on cash option)

- The data entry check list is now much more extensive (four-pages)

- Your investment portfolio information can now be saved with the PIA file.

- IRR more precise (monthly calculations over all time frames)

- Additional reports have been added (e.g. Wealth Builder) and the report

menu restructured (many reports are now accessed from more logical parts

of the program)

- A revised PIA Quick Start Guide has been released

- A revised PIA Users Guide has been released

Changes in PIAPkt 1.017 (24-Feb-05)

- IRR calculations more precise (monthly

calculations over all time frames)

- Problem with cash flow graphic presentation with

P&I loans now fixed

- Minor spelling typo now fixed

Changes in PIAPro, PIAFpu, PIAPer Edition 7.0.20, PIAPkt 1.016 (3-Jun-04)

- Changes to default Australian Tax Scales (effective 1 July, 2004)

- Changes to Selling Costs item (Settings menu) to cater for new NSW

stamp duty tax on sale

- Fixed problem with transfer of Pocket PC files to Desktop versions

- Fixed stamp duty label in Purchase Costs dialog (PIAPkt)