| Installation and Updates | ||

| My computer's hard drive has crashed and taken my copy of PIA with it. How can I recover my program? | ||

|

If you still have your registration details (these are on the back of the original CD case and/or in an email sent to you when you purchased PIA) then it is fairly easy. If not, you will first need to contact Somerset to obtain them.

The next step is to download and install your original version of the PIA software from the web site, or better still, to choose the last free update for which your registration code is still eligible. If you have purchased the software sometime in the past two years, you will still be eligible for free updates and would simply download the latest one (see www.somersoft.com.au/pia_updates.htm). Previous updates can be accessed via the Previous Versions tab on this page or you can always order an updated registration code for the latest update via the secure web site order form. Once you have the software re-installed, it will only run in demonstration mode until you enter the licensee name and corresponding registration code. You can do this when starting the program (click on the Register button) or via the Register item under the Help menu. |

||

| My program will only run in demonstration mode. | ||

| PIA will run in demonstration mode if it does not have a corresponding registration file. This might happen if you have replaced the program with a later version or you have downloaded the incorrect program (PIAPro instead of PIAFpu or vice versa). The problem is easily resolved if you check the licensee and registration details that you have received when you first purchased the software. If the program and version number agree, re-enter the licensee and registration codes (Help menu/Register) and all will be well. If not, contact Somersoft | ||

| I have downloaded the latest updated edition of PIA but it does not seem to have updated my tax scales. | ||

| The tax scale used when creating a property file are always saved with the file. Thus even if the tax scales are updated when a new maintenance edition is released, this scale is only used in new files that are created. To update the tax scale in a previously saved file, open the file, choose Tax Scales under the Settings menu, then choose the latest scale (Australia or NZ, whichever is appropriate). | ||

| Investment Analysis | ||

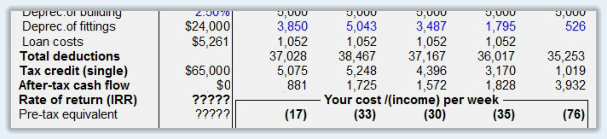

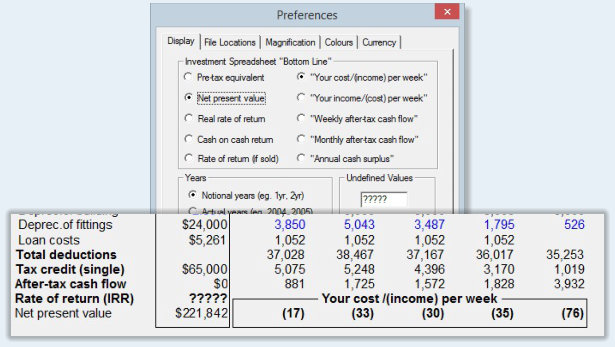

| What does "?????" mean in the IRR cell in the Input column of the investment analysis spreadsheet? | ||

|

It simply means that the internal rate of return can either not be calculated or is not applicable.

It usually signifies an infinite return and hence a great investment!

For example, it would not be possible to calculate the return on investment for a property purchased

with borrowed money which also produces a positive after-tax cash flow – effectively a license to print money.

With no money invested, it is impossible to calculate a return on investment!

Such a situation can arise when you have low interest rates and relatively high net rents and

non-cash tax deductions (e.g. high depreciation claims).

However, if a positive cash flow is generated simply by capitalising the interest,

this can result in a negative equity at the end of the projected period. In this situation,

the internal rate of return is not applicable as it would actually be a measure of the effective "interest"

being paid on the equity being extracted from the property. |

||

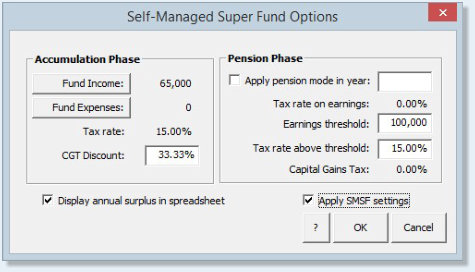

| How do I analyse an investment property purchased by my Self-Managed Super Fund (SMSF)? | ||

With rule changes in recent years allowing SMSF's to borrow funds, it is now more common for individuals to

invest in property through their own self-managed superannuation fund. But how is this best handled in PIA?

Firstly, it is important to remember that, in this case, it is the SMSF that is the investor.

Hence the tax scales and CGT costs etc must be set accordingly to the entity. I recommend the following...

|

||

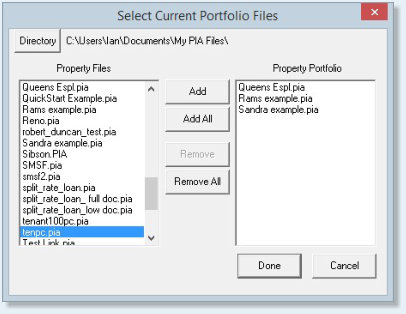

| I bought an investment property several years ago. How do I include that property into my analysis? | ||

|

IThe way to do this is to define it as part of your existing

investment portfolio. You must first create a PIA file which

simulates the existing property so that when you create a

portfolio, you simply need to specify which files are to be

included. You can either simulate the investment cash flows

from the year of purchase (specify the year in the year row

of the Input column in the spreadsheet) or simulate them

from the present year (in which case you would need to

specify your existing equity in the property in the

Investments dialog). Either way, PIA will extract the

synchronised projected cash flows and property values etc

from the specified files in order to adjust the taxable

income used in calculating the correct tax credits for any

new property that you might evaluate. Furthermore, the

existing portfolio will also form part of the base of your

investment portfolio in the Wealth Builder spreadsheet. |

||

| How do I analyse an investment property which is being purchased by myself, my brother and my sister? | ||

|

The financial model in PIA is constrained to a maximum of

two people (investor and partner) as it is assumed that the

cash flows will be joint cash flows and all of the more

advanced tools in the program (e.g. Wealth Builder

spreadsheet) assume that borrowing capacity will be based on

joint incomes and joint living expenses etc. Thus, in

situation where this assumption does not hold (e.g. when

there are three or more involved in a syndicate), it is

simply a matter of dividing the investment into equal

proportions and doing a separate analysis for each

individual. |

||

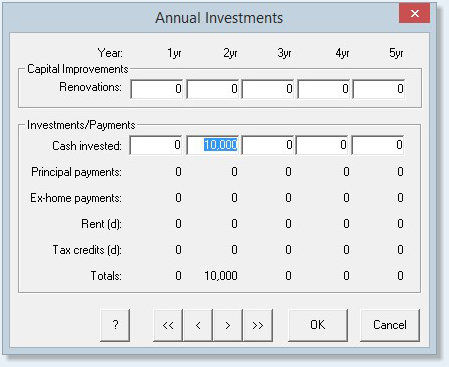

| How do I specify lump sum payments off the investment loan? | ||

|

The program allows you to specify ad hoc lump sum payments

at the end of any year in the projected period. To do this

you can click on the After Purchase button in the

Investments dialog (or click anywhere in the Investments row

on the Investment Analysis spreadsheet) to bring up the

Annual Investments dialog. This will allow you to specify

any lump sum cash investments (or to specify any money

borrowed for renovations).

|

||

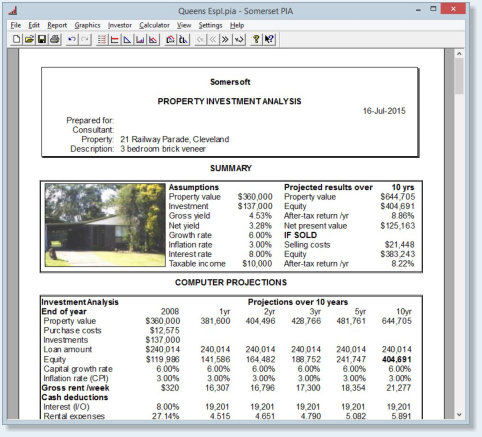

| In the investment report summary, what does Net Present Value mean? | ||

|

The Net Present Value represents the net increase in the

total value of the investment measured in today's dollars.

In other words, it measures the difference in the projected

market value of the property (in today's dollars) less the

total cost of that investment (including negative annual

cash flows) in today's dollars. It is a useful index as it

is a measure of how much money you are likely to make on the

investment given the assumptions you have made. It can

always be calculated, even when an IRR can't (e.g. for

positive cash flow properties) so it helps to keep infinite

rates of return in perspective. To display the Net Present

Value at the bottom of the Investment Analysis spreadsheet,

choose it in the Preferences item under the Settings menu.

|

||

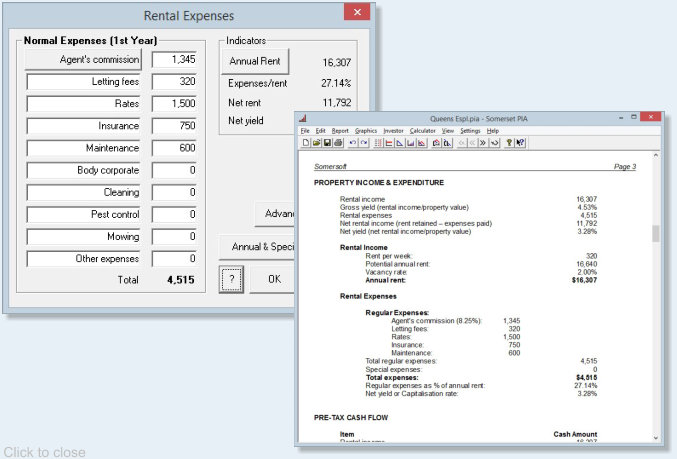

| How do I account for Land Tax in the calculations? | ||

|

Land tax is a State-imposed tax that has become an

increasingly important issue for successful property

investors. The land tax rules change from State to State (NZ

and NT have none) and, in general, depend on the total land

value owned in each State. It is treated by the Australian

Tax Office as if it were another rental expense and in PIA,

the Rental Expenses dialog is where we recommend you enter

the land tax component for any new property you are

analysing. While it is not possible to fully integrate

automatic land tax calculations in the software because of

the complications of joint-ownership and properties held in

different States, we have added a Land Tax calculator in the

new version to at least help you in this process (Calculator

Menu). |

||

| Why is the investment loan being reduced, even though I have specified an interest-only loan? | ||

|

It usually means that you have inadvertently specified that

rental income and or and tax credits are to be used to make

principal payments off the loan whereas normally these are

used to service the interest bill. Make sure that the

relevant check boxes in the rent and tax credit dialogs are

unchecked. |

||

| Why do the depreciation of fittings claim increase in the second year? | ||

|

In recent years, the Australian Tax Office has a category to

cover depreciable items under $1000. This category is called

the Low Value Pool and all items are written off at a

diminishing value rate of 37.5% per year, except for the

first year for which the rate is 18.75%. Hence, if this

category forms a large component of the total depreciable

items, the depreciation claim for the second year may well

be higher than that for the first year of the investment. |

||

| How is the capital gains tax calculated? | ||

|

This is one of the most complicated aspects of Australian

property tax law and one that has been changing in recent

times. For capital gains tax purposes, fixtures and fittings

are treated as separate assets to that of the property. The

tax is only calculated on gains over and above inflation and

there are special averaging provisions that tend to cushion

its effect, especially if other taxable income at the time

of sale is low (see pp 140-141 of Building Wealth through

Investment Property for more detail). Since May 1997,

building depreciation claims must now be written back and

the cost base adjusted accordingly when calculating the

taxable gain. To help users understand more clearly how the

tax liability has been estimated, the Professional versions

of the Australian PIA software now include a detailed

capital gains tax report. |

||

| What value should I use for capital growth rate? | ||

|

A figure that you think is appropriate for the location, the

style of building and most importantly, the time period over

which you will be making projections (hopefully between now

and retirement, however long that may be). Do not be unduly

influenced by what is happening today, or even this year, as

it is the longer term growth rate that is most relevant. You

may use long-term historical levels as a guide, but it is

most important that you do not consider changes to the

capital growth variable independently from changes in the

inflation and interest rate variables. There is no

definitive relationship but, while growth in property values

has varied considerably over the years, over any significant

period, it has generally exceeded the inflation rate by

about 2 to 3%. Interest rates would normally exceed the

growth rate by about the same margin.. |

||

| Can I examine the implications of using a line of credit with the PIA software? | ||

|

Lines of credit are commonly used nowadays for accelerated

reduction of a home loan. By paying all one’s income into

the account and withdrawing living expenses as required can

result in drastic reductions in the term of a loan. While

there is a small advantage gained through using credit cards

to extend interest free use of someone else’s money, the

major reduction comes about because more is being paid off

the home loan. The Professional versions of PIA have a home

loan analysis spreadsheet that can be used to simulate the

effect of making these additional payments. The living

expense budget feature can be used to work out how big these

additional payments might be. |

||

| What have I done to make my cost per week appear so high? | ||

|

You may be using a short term principal and interest loan,

in which case the higher cost per week can largely be

attributed to the significant principal payments. Look at

using interest only finance. You may have inadvertently specified that rental income and/or tax credits be used to repay the principal on the investment loan. If this is the case, the interest bill has to be serviced by you alone and hence your after-tax cost per week will rise accordingly. Make sure that the relevant check boxes in the rent and tax credit dialogs are unchecked (see 2 above). |

||

| What does a negative cost per week mean? | ||

|

The double negative actually means that your cash flow is

positive (the investment is paying you money). |

||

| Why does the program have a separate item for furniture in the property value dialog, but not fixtures and fittings? | ||

|

Some properties are bought with a furniture package as an

option in the purchase (e.g. furnished holiday units).

However, it is traditional in purchasing and/or selling

property that the property price include fixtures and

fittings (carpets, curtains, etc). The furniture is thus

identified as a separate item in any purchase, however, all

items can be separated and identified for depreciation

purposes. |

||

| How are fixtures and fittings, stamp duty and construction cost are linked to the property price? | ||

|

To make it easy for someone to get a quick and reasonable

bottom line, a number of assumptions are made with the

model. By default, when someone enters a new property value,

the appropriate stamp duty is automatically calculated,

along with estimates of the amount of depreciable items (6%

of property value) and the original construction cost of the

building (50% of property value). The normal procedure would

be to then refine these values where appropriate. However,

it is possible to change this default behaviour so that

changing the property value does not change these other

related items – simply un-check the relevant check boxed in

the Property Value dialog. |

||

| Interface | ||

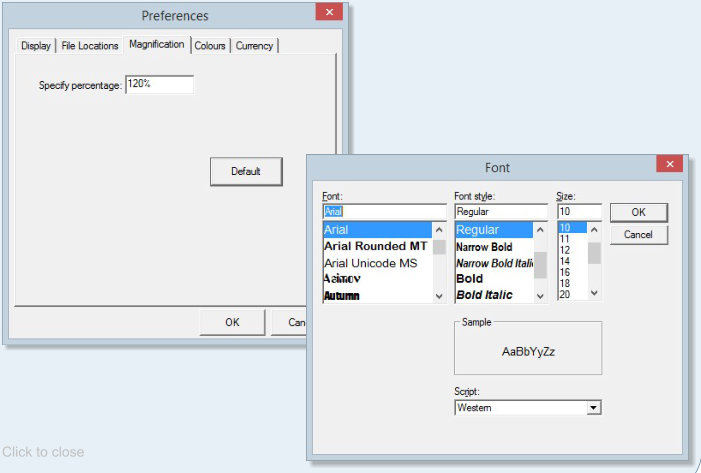

| How do I change the size of the spreadsheet font so that I can read it more easily? | ||

|

The best way to make the spreadsheet larger and more

readable on screen is to change the Magnification setting

(Preference item under the Settings menu). Changing the

magnification from 100% to 150% will increase the

magnification by 50%. An alternative is to increase the size

of the font (Settings menu/Set Font), but this will also be

reflected in printed reports and if the font is made too

large, adjacent fields may overlap. |

||

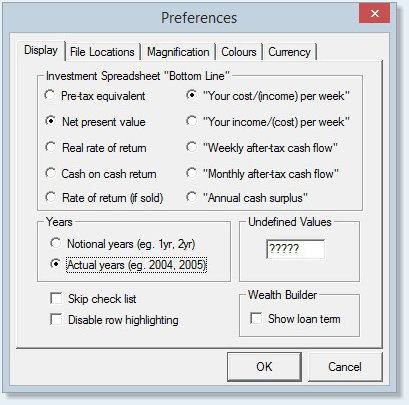

| Is it possible to display actual years (e.g. 2015 2016, etc) rather than the number of years since purchase? | ||

|

Yes. Simply choose that option under the Preferences item of

the Settings menu. Keep in mind when doing so that the

financial model is still operating in integer years after

purchase and is not aligned to specific financial or

calendar years (as in the date of purchase is only used in

the Tax Variation dialog) as the purpose of PIA is as a

modelling tool not an accounting tool.

|

||

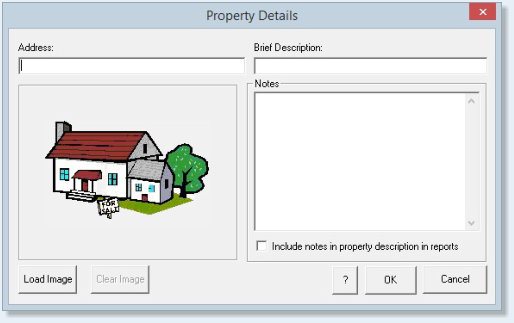

| Where do I enter the property description and address? | ||

|

This can be done in the Property Value dialog (click on the

Property value row title) or simply by clicking on the

Property Details region of the spreadsheet. There is now a

specific Property details dialog that not only allows you to

enter these details, but also a jpeg image of the property.

|

||

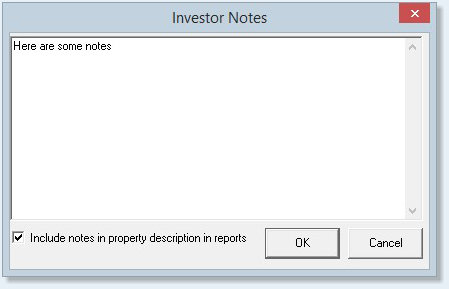

| How do I print the notes that I have entered in the Notes dialog? | ||

|

The notes facility was originally intended to provide users

with a place to store information about the property under

review or about the client for whom the analysis was being

carried out, or for whatever other purpose the user needed

without necessarily having that information appear in any of

the reports that could be generated. However, by clicking

the appropriate checkbox, it is now possible to have those

notes appear as part of the property description when it

appears in a generated report. Otherwise, to print them,

just copy them to Notepad or Word. To do this, select the

text in the Notes text area and press Ctrl/C (this puts it

on the clipboard). Then switch to say Notepad and press

Ctrl/V.

|

||

| Why, when I ask the program to print, does it only give me just half a page of information? | ||

|

What you see is what you get (wysiwyg)! If the page you are

viewing is the spreadsheet interface, that is what will

print. To print a full report (multiple pages), you must

first generate that report (see Report Menu items).

|

||

| How do I get it to print the contents of the rental expenses dialog? | ||

|

To print the contents of any dialog (such as that for Rental

Expenses), you would need to copy its image to another

application such as Paintbrush or Word via the clipboard

(hold down the Alt key and press the PrtSc key to copy the

currently active window to the clipboard). However, for most

of the dialogs with lists of items pertaining to the

analysis, the contents will appear as part of a generated

report that can easily be printed.

|

||

| Home Loan Analysis | ||

| Do I need to enter my home loan details every time I evaluate another investment property? | ||

|

No, but you will need to have specified your home loan

status, repayment commitments, and personal living expenses

if you want the software to calculate whether or not you can

afford the property (Investment Capacity dialog), when you

can afford the next one or whether the bank is likely to

lend you the money needed (Wealth Builder spreadsheet). Once you have entered such details, you can make them part of the starting template (Save Default Template under the Settings menu) for any new property files that you create so that you do not need to enter them each time. |

||

| How do I specify interest-only payments on my home loan? | ||

|

Normally home loan payments are based on a principal and

interest loan. However, in the Home Loan Analysis

spreadsheet, you are able to modify the monthly repayments

to anything you wish (to see what impact it may have on the

term of the loan). Simply calculate the monthly

interest-only repayment (Loan Payments calculator under the

Calculators menu) and enter that into the regular monthly

payments field of the Home Loan Analysis spreadsheet.. |

||