Example 8 - Using cash surplus from an investment property to help repay a home loan

This example shows how to direct a surplus cash flow from an investment into repayments for a home loan. We will start with an existing home loan which still has a significant term remaining and an investment property that is (or almost) cash flow positive and examine what impact it will have on the home loan if we link the two loans. We will explore various finance options in relation to the investment loan to see how soon we can repay the home loan and, optionally, the investment loan.

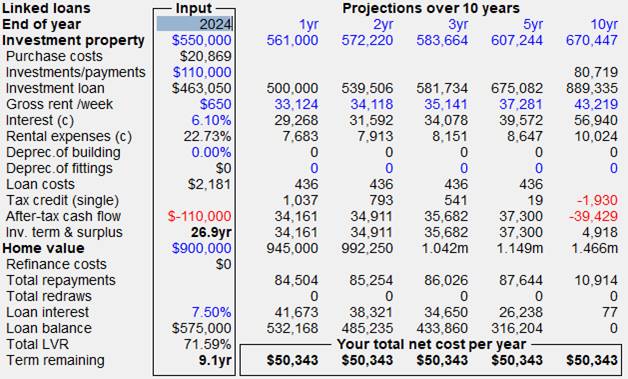

Property and loan details:

Home: The principle place of residence is currently valued at 900k but has an existing mortgage of $575k at 7.5% P&I and regular monthly payments of $4195/month,.

Investment property: The investment property is an established property (45 years since construction) in a country town in Queensland. The property will cost just $550k and is expected to rent for $650/week (2% vacancy rate). While the yield is relatively high (6%), the growth prospects are limited (2%).

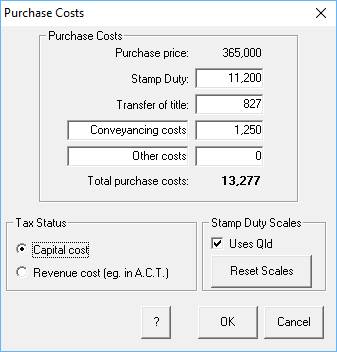

The purchase costs (20,869) include stamp duty (17,775), transfer fees (1844) and conveyancing costs (1,250).

Rental expenses are estimated at $7,683 per year.

As the building is already 45 years of age, there is no building depreciation to claim and (as of 1 July 2017) nor are there any depreciation claims for fittings.

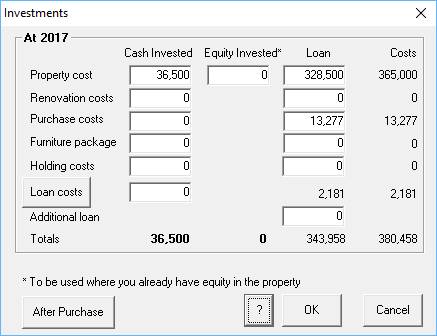

Investment loan: After a 20% cash deposit ($110k), an interest-only loan was arranged at 6.1% to cover all remaining costs, including purchase and loan costs. The total loan costs amount to $2,181. The total loan required is $463,050.

Investor details:

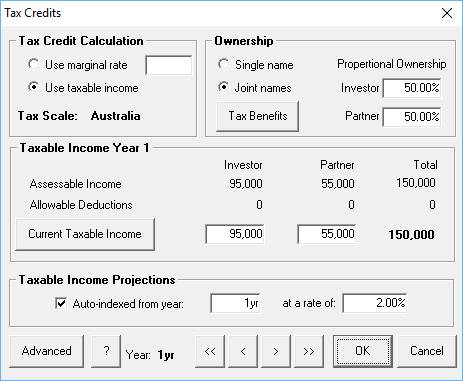

The investor’s current annual taxable income is $125,000 per year, his spouse’s is $50,000. They estimate that their annual living expenses are about 45,000 per year, excluding the home repayments. They intend buying the investment property in joint names.

What If?

If we assume that growth in value of the investment property of 2% and that of principle place of residence at 5% and an inflation rate of 3%, what is the remaining term of the home loan if…

1. They continue their normal home loan regular payments

2. They purchase the investment property and use any available cash from it as well

3. They capitalise the interest and rental expenses on the investment property.

What are the steps?

1. Create a new file and enter the investment parameters (specified above). Under the Investor tab in the Data Entry Check List, enter the investor details, home loan details and living expenses as specified above. Click on the Spreadsheet button to reveal the Investment Analysis spreadsheet.

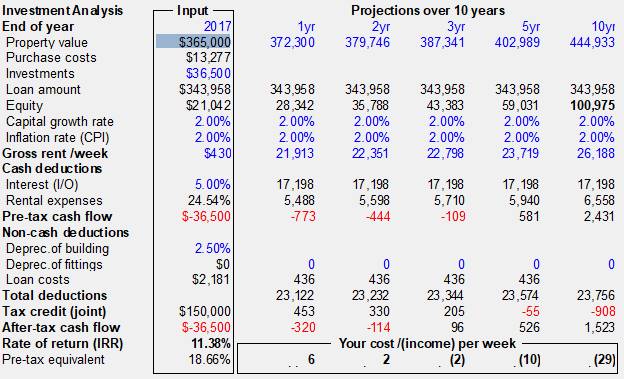

Note that the cash flow is slightly negative in the first four years but becomes cash flow positive after that, though not significantly.

2. Switch to the Home Loan spreadsheet (View menu/Home Loan Analysis)

3. Note that this spreadsheet automatically reveals the answer to the first question that we have listed. It will take another 26 years of repayments (50,343/yr) before the home loan will be repaid.

4.

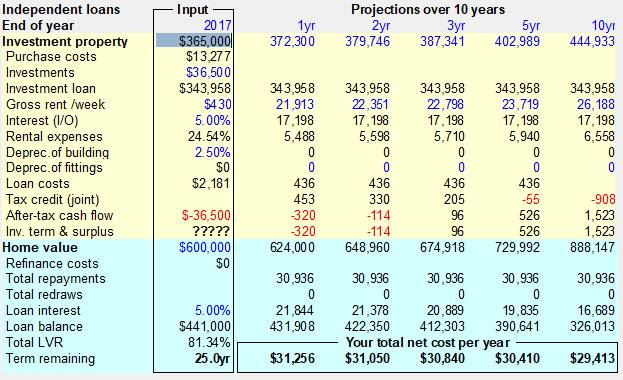

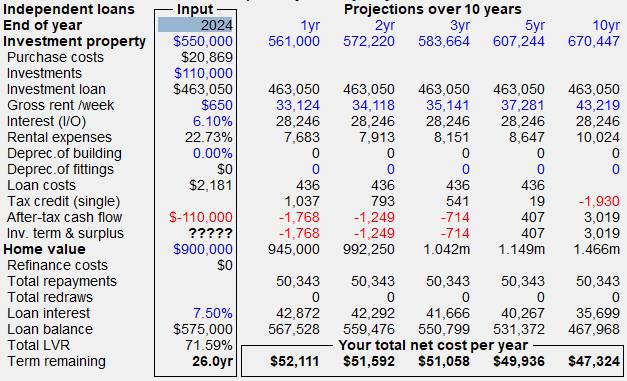

Now switch to the Linked Loan spreadsheet (![]() View menu/Linked Loans). Initially this spreadsheet will show the key rows from

each of the previous two spreadsheet (Investment property and the Home) with

the loans remaining independent entities (Note the term "Independent

loans" in the top left corner of the spreadsheet). The last row for

the Investment property (Inv. term & surplus) shows "?????" in

the Input column because the investment loan is interest only and is never

repaid. The rest of the row is the "surplus" cash flow (initially

negative).

View menu/Linked Loans). Initially this spreadsheet will show the key rows from

each of the previous two spreadsheet (Investment property and the Home) with

the loans remaining independent entities (Note the term "Independent

loans" in the top left corner of the spreadsheet). The last row for

the Investment property (Inv. term & surplus) shows "?????" in

the Input column because the investment loan is interest only and is never

repaid. The rest of the row is the "surplus" cash flow (initially

negative).

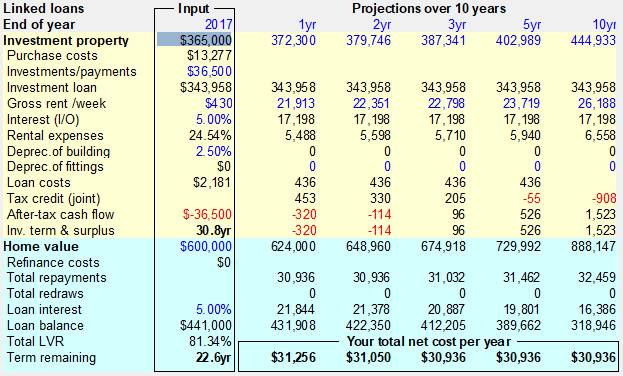

The term remaining for the home loan is still 25.0 years. Choose to link the loan by either clicking the “Independent loans” title in the top-left corner of the spreadsheet or on the toolbar icon or the item in the Settings menu. The surplus cash flow from the investment property is now added to the home loan payments. The Independent loans title will switch to Linked loans and the Term remaining for the Home loan will drop to 22.4 years.

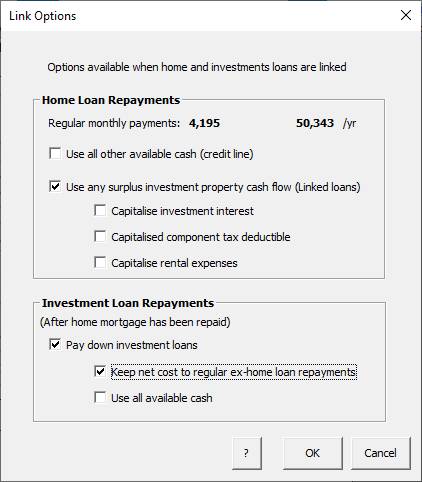

5. Now we will look at the options available if we are to link the loans (Settings menu/Link Options). For simplicity, let's look at just using any surplus cash flow from the Investment property to repay the home loan and once it is repaid, use the surplus and other monies to then pay down the investment loan, but limit the net cost to that of the regular home loan payments.

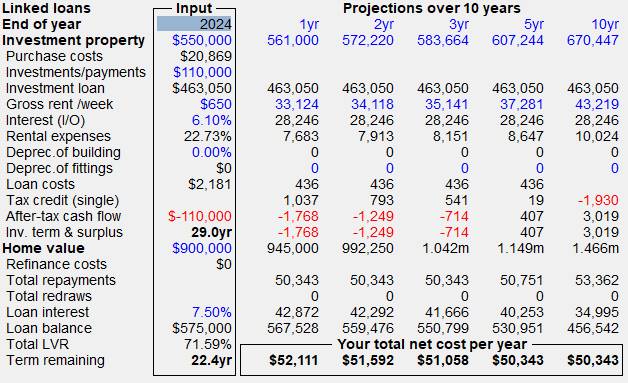

6. The Linked Loan spreadsheet should now look like this below with loan terms remaining of 22.4 yrs (Home loan) and 29.0 yrs (Investment loan).

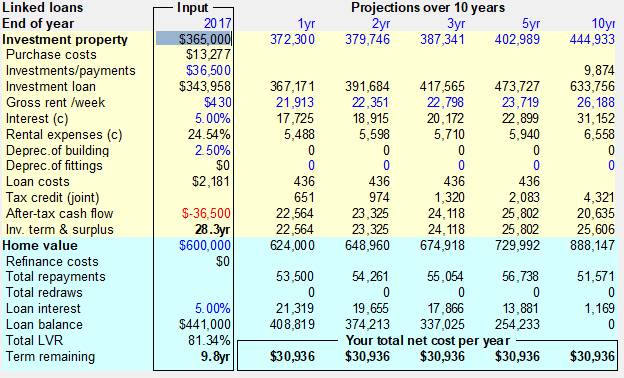

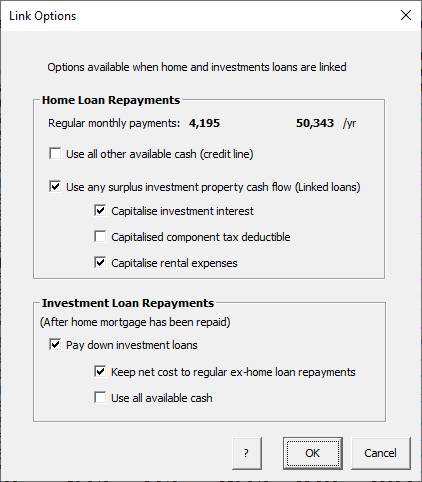

7. Now choose the Link Options item under the Settings menu and by choosing to capitalise the interest and rental expenses on to the investment loan, we can generate an even greater cash surplus to accelerate the home loan repayment. In this example, we will assume that the interest on the capitalised portion of the investment loan is not tax deductible. While this should be checked for individual situations, if it were deductible, it would mean that we would be effectively replacing non-deductible debt with deductible debt. While in this dialog, we will also choose to repay the investment loan once the home loan is repaid, but again limit the repayments to that which they have been making as regular home loan repayments.

Note that a “(c)” now appears in the Interest and Rental expenses row titles, indicating that these are capitalised in the investment loan. The net result is that the home loan will be repaid in 9.1 yrs and the investment loan will have been repaid in 26.9 yrs.

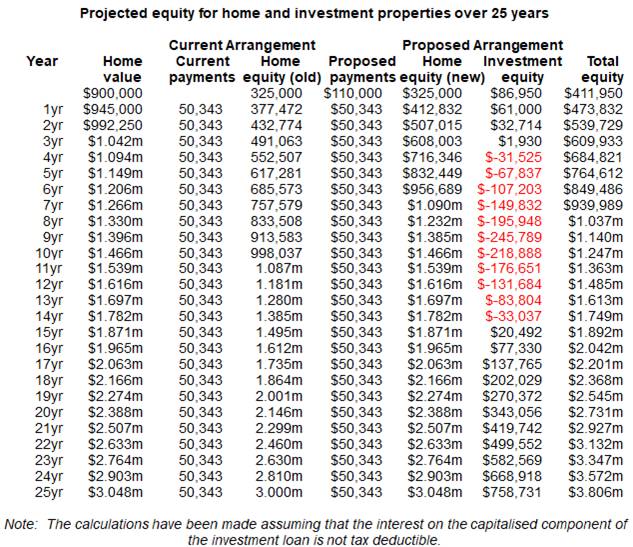

8. Now generate the Linked Loan Analysis report (Report menu) and compare the original arrangement of repaying the debt on the home loan with the proposed arrangement as described above. Apart from the additional 110k cash deposit, the net cost per year (i.e. proposed repayments) are the same, but the result is very different. At the end of 25 years, both show the same equity in the home, but in the proposed arrangement, there is an additional $758,731 in equity generated in an investment property (see Page 4 of the report).