Example 7 – Investigating simple ways to reduce a home loan

Property details:

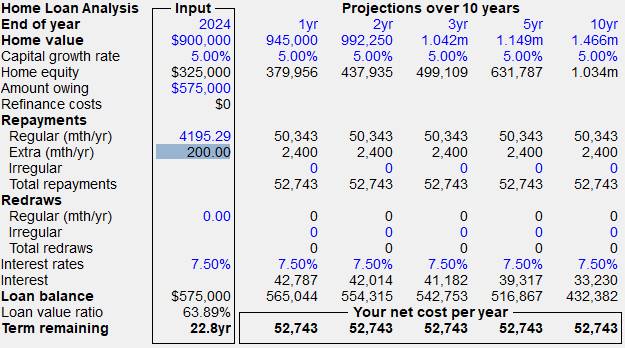

A principle place of residence worth 900k growing value at a rate of 5% per year.

Loan details:

Principal and interest finance had been four years earlier on a loan of 600k at 7.5% over 30 years. They now owe 575k on the loan and are paying 4195 per month in loan payments with a projected 26 years to run if the interest rate remains at 7.5%.

Investor details:

The investor’s current annual taxable income is $125,000 per year, his spouse’s is $50,000. They estimate that their annual living expenses are about 45,000 per year, excluding the home repayments. They are interested in ways that they may be able to own a bigger piece of their home earlier than 25 years. Income and expenses are assumed to grow at 3% per year.

What if:

· What impact would it have on the term of the loan if they were to pay an extra $200 per month?

· What if they paid half the monthly amount fortnightly?

· What is they were to make a one-off payment of $2000?

· What if they were to put all the available cash they could afford into the loan?

1. Create a new file and from the Data Entry Checklist, click on the Investor tab. In this example we are not interested in the parameters for the investment property as we are dealing solely with the Investor’s home loan.

2. Click on the Investor details and enter 125k and 50k in the work-related income for the Investor and partner

.

3. Click on the Principle Residence item and enter current home loan status as specified.

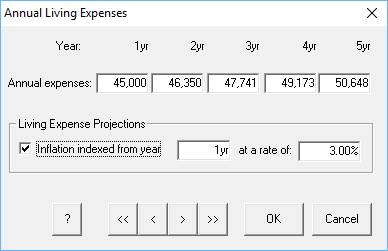

4. Set the living expenses to 45k and the rate of indexing to 3%.

5. Click on Spreadsheet and then choose the Home Loan Analysis spreadsheet.

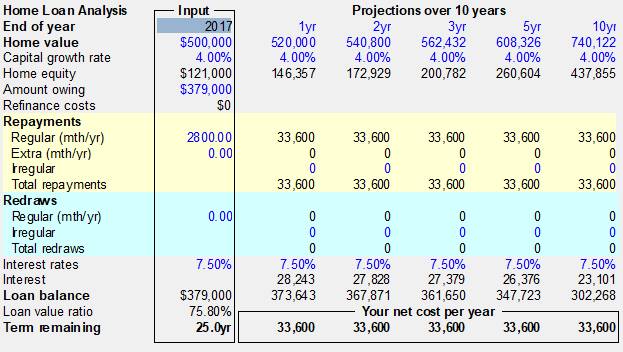

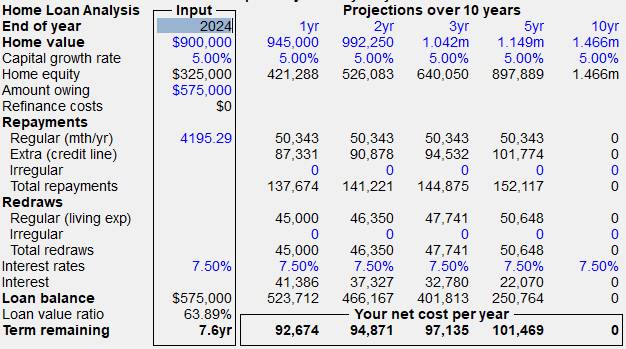

The bottom line shows that there will be 26.0 years before the loan will be repaid.6. To see what impact an additional $200 repaid each month would have, enter 200 in the Input column in the Extra (mth/yr) row. The Term remaining drops to 22.8 years.

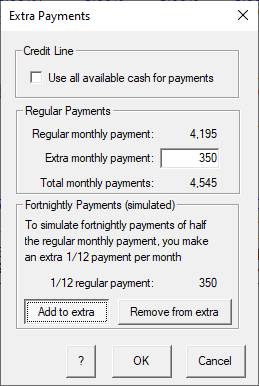

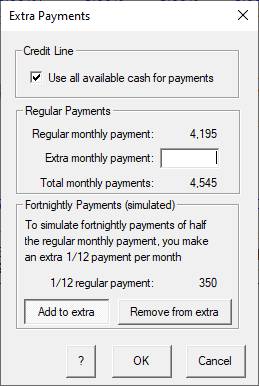

7. Now click on the Extra (mth/yr) row title to bring up the Extra Payments dialog. This is divided into three sections: a Credit Line section, a regular payments section showing the regular monthly payment of 4195 plus the extra monthly payment of $200 that we have just entered, and a Fortnightly Payments section. (To see the impact of making half payments fortnightly, it means 26 payments for the year, which is one extra monthly payment, which in turn is the same as making an extra 1/12 payment each month.) Remove the 200 from the Extra monthly payment field and click on the Add to extra button in the lower section.

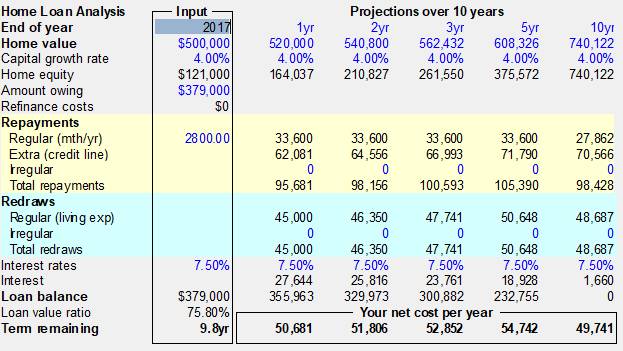

The extra monthly payment now becomes $350 (i.e. 1/12 of 4195 = $349.61). Click OK and you will note that the term of the loan will have dropped to 20.9 years.8. To see just how fast this couple can repay the home loan, we again bring up the Extra Payments dialog and this time remove the extra payment of $350 and instead choose Credit Line. Click OK to return to the spreadsheet. To row title will have changed to “Extra (credit line)”, the extra amounts will vary each year and the term remaining will have dropped to 7.6 years.

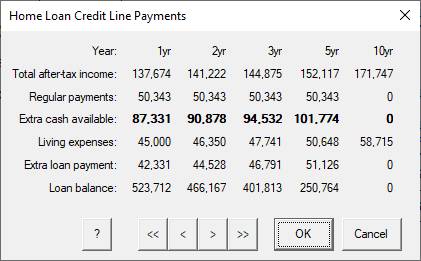

9. Note that the living expenses are presented as regular redraws (from the credit line). To see exactly how much is being repaid off the home loan each year under the Credit Line model, click on the first years figure in the Extra (credit line) row (87,331).

In the first year, there is a total of $42,331 available for extra loan repayments but that this amount increases with time until the loan is repaid.