Example 6 – Investing in a house and land package

Property details:

Let us again begin with the property described in Example 1, but this time we will consider it as being a house and land package in which the building is constructed over a six month time frame with the intention of renting it after settlement. This was a Queensland house and land package (three bedroom brick residence to be built on a large block) that is for sale for $870,000 and is to be rented for $870 per week. Apart from standard rental management and letting fees, rental expenses will include rates ($2250), insurance ($1150), maintenance ($1200), pest control ($250) and other costs ($250). The land costs $380,000, the actual construction cost of the house will be $430,000. The remainder of the cost covers fixtures and fittings (46,000), landscaping etc (14,000). The purchase costs include normal State Government stamp duty on the land, title transfer fees and $1850 solicitor’s fees to cover the conveyancing.

Loan details:

Principal and interest finance can be arranged at 6.4% over 30 years to cover all costs, including purchase and loan costs. The total loan costs ($2,232) include a fixed establishment fee of $500, no mortgagee insurance, and the remainder of the loan costs are as per the program defaults.

Investor details:

The investor’s current annual taxable income is $125,000 per year, his spouse’s is $50,000 and they wish to purchase the property in joint names. They currently own their own home and have estimated annual living expenses to be $45,000 per year.

What if:

If they use their own home as collateral and borrow the entire amount for the investment property, what sort of a return (IRR) can they expect over a ten-year period if the annual growth rate is 5% and the annual inflation rate is 3%.

- What sort of return on investment can they expect?

- How much will they need to find (after tax) to service the debt?

- How does it compare to investing in an established property?

What are the steps?

1. Choose the investment analysis spreadsheet (Menu: View/Investment Analysis).

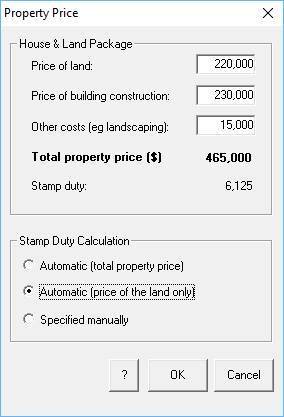

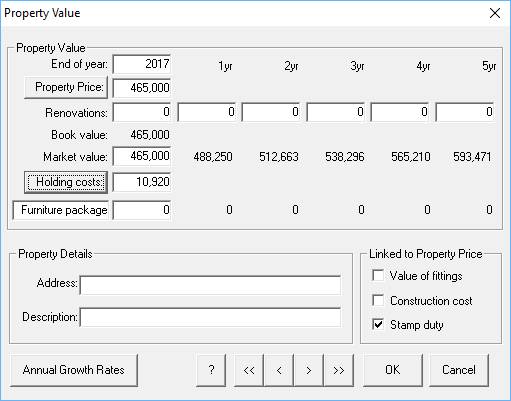

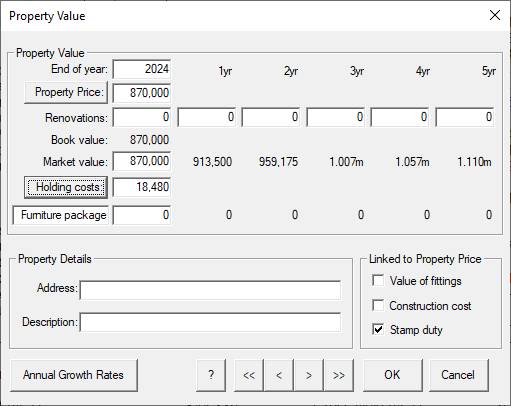

2. Property price: Click on the “Property value” row title with the left mouse button and the Property Value dialog will appear. Now click on the Property Price button and it will bring up the Property Price dialog. Enter 380k for the price of the land, 430k for the price of building construction and 60k for other costs (landscaping, fixtures and fittings), bringing the total property price to 870,000. Now choose the Stamp Duty Calculation to be on the price of the land only, then click OK.

3. The property will take 6 months to construct and there will be holding costs associated with this phase. These holding costs need to be taken into account in any cash flow analysis and by clicking on the Holding costs button, a Holding costs template will appear. Enter the interest rate (7.2%) and the various draw-downs during the construction phase as shown below (total Holding costs of $18,480). Holding costs associated with the land are considered by the ATO as a capital cost whereas those associated with construction may well be claimed as a tax deduction during the first year of renting (check with the ATO).

4. The remaining steps are exactly the same as those of Example 1.

What’s the bottom line?

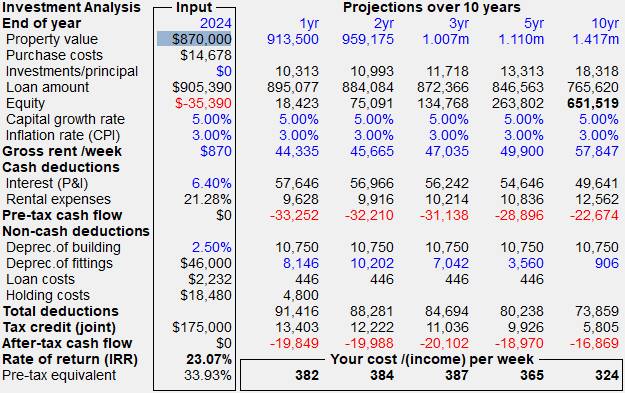

The estimated after-tax internal rate of return should show 23.07% (This assumes that they are calculated using the 2024/25 Australian tax scales). Their contribution in the first year is $19,849 (after-tax cash flow) or a cost of about $382 per week. The equity built up in the property after ten years is estimated to be $651,519.

How does it compare to investing in an established property?

If we compare it to the $870k property in Example 1 (also a new property), the return and after-tax costs are very similar. The main difference between the figures for the two examples is that the Purchase costs (14,678) are much less for this property than the earlier one ($37,263) because the State Government charges for stamp duty and transfer of title are based on the land only, but there are holding costs during construction phase ($18,480) that are not incurred in the established property. Please note however, that of the total holding costs, only those associated with the construction phase (4,800) were claimed in the first year.

However, if we were to compare new properties to second-hand established properties, a significant difference is in relation to the tax treatment of fixtures and fitting. Since July 2017, these would not be claimable on established second-hand properties as the fixtures and fittings are presumed by the ATO to be already written off. Another factor would be that the building depreciation is based on the original construction cost of the building, not the perceived sale price of the building.