Example 5 – Accumulating investment properties

This example serves to show several things…

a. How to take account of existing investment properties when evaluating the tax benefits and projected returns on additional investment properties.

b. How to analyse the cash flows on an entire portfolio of investment properties

c. How adding additional properties to an investment portfolio can increase the return s on the portfolio through increased gearing.

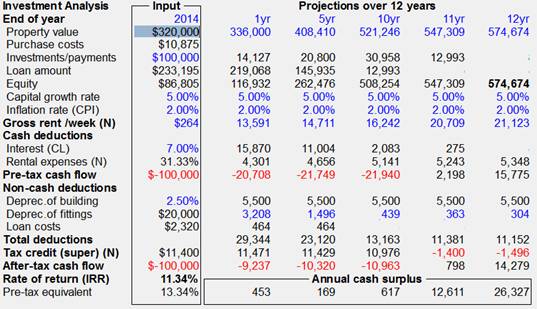

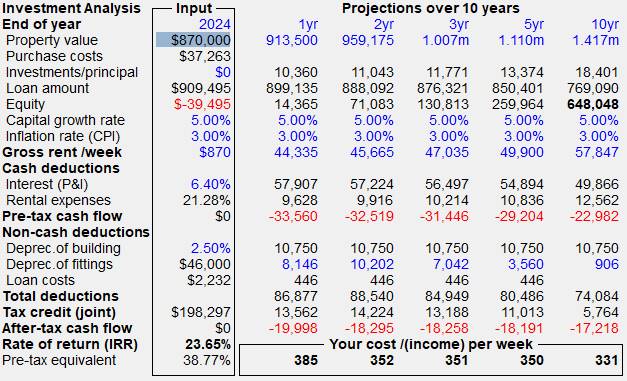

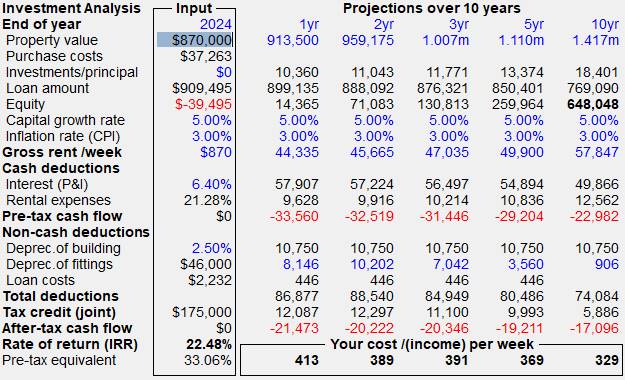

Let us now consider the case where the investors already own an investment property and are considering the possibility of purchasing another one. For simplicity we will again use the property from Example 1, both as the property they currently own and as a property they are considering to purchase. It is a property valued at $870,000 and which rents for $870/week.

Property details:

Let us suppose the old property they own is worth $870k today but they purchased it as an new investment property about 20 years earlier for $220,000 for which the original construction cost was $110,000. They are renting the property for $870 per week. As well as this property they are considering purchasing a new investment property (Example 1) for $870k to be rented at $870 per week.

Loan details:

The couple still owe 140k on their old investment property for which they have about 10 years to run (repaying $1,580 per month at 6.4%). The finance for the new property is as per Example 1 (Principal and interest at 6.4% over 30 years to cover all costs, including purchase and loan costs. The total loan costs ($2,232) include a fixed establishment fee of $500, no mortgagee insurance, and the remainder of the loan costs are as per the program defaults.).

Investor details:

As per Example 1, the investor’s current annual taxable income is $125,000 per year, his spouse’s is $50,000 and they wish to purchase the property in joint names. They currently own their own home and have estimated annual living expenses to be $45,000 per year.

What if:

The annual growth rate for the property was 5% and the annual inflation rate 3%.

· What will be the cost per week for the new property given the existing property?

· What will be the cost per week for both properties together?

What are the steps?

1. Create a new spreadsheet and enter the details as per Example 1. To distinguish it from the older property, enter the term “new” in the property address. Then save it as “NewPlace”.

2. Now change the item in the address from “new” to “old” and to be safe, save it as another file but with the name “OldPlace”.

3. A number of changes need to be made to this file to more accurately describe its current status and cash flow. We could simulate the property from when it was originally purchased, but it will be sufficient to make the appropriate adjustments to the data if we are simply looking at the cash flows from this point on. So, in effect, we will simply simulate it as if they are purchasing it from themselves (i.e. a paper shuffle) without purchase costs etc.

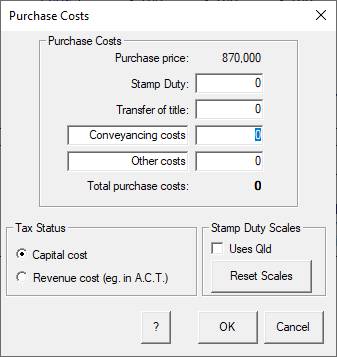

4. Open the Purchase Costs dialog and set all costs to zero.

5. Open the Loan Costs dialog and set the Loan costs to zero.

6.

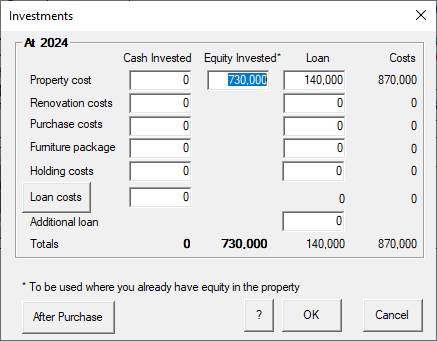

7. Open the Investments dialog and set the Equity invested to $730,000 so that the loan on the property is $140,000

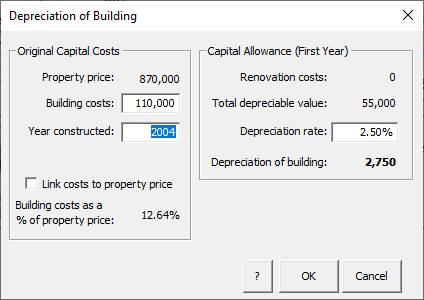

8. Open the Depre. Of Building dialog and set the Building costs to 110k and the year to 20 years earlier (2004).

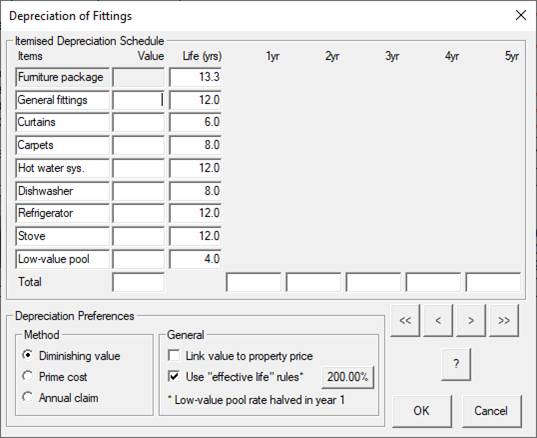

9. Open the Deprec. Of Fittings dialog and set the values to zero (as all will have been written off).

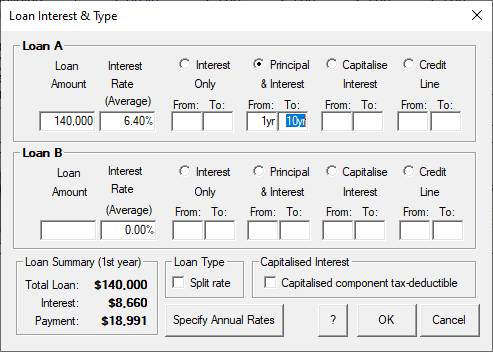

10. Open the Loan Interest & Type dialog and enter a P&I loan over 10 years at 6.4%.

11. Click OK to return to the spreadsheet and save the file as “OldPlace”...

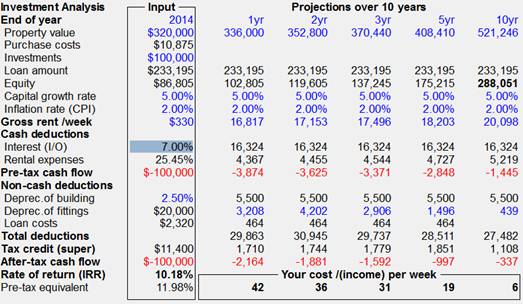

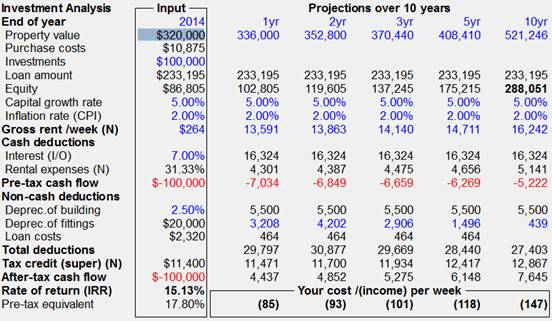

Despite the annual loan repayments of 18,991 per year, the property by this stage is cash positive generating at least $7,972 per year ($153 per week). It also shows that the projected IRR over the next 10 years is just 7.78% (as the level of gearing as dopped over time). If we open the Tax Benefits dialog (you can click on the -7,745 item in the Tax Credits row) you can see that their current taxable income given the ownership of this property is actually $198,297, not just the $175,000 of their combined salary. This is important when looking at the implications for tax benefits from the next investment property.

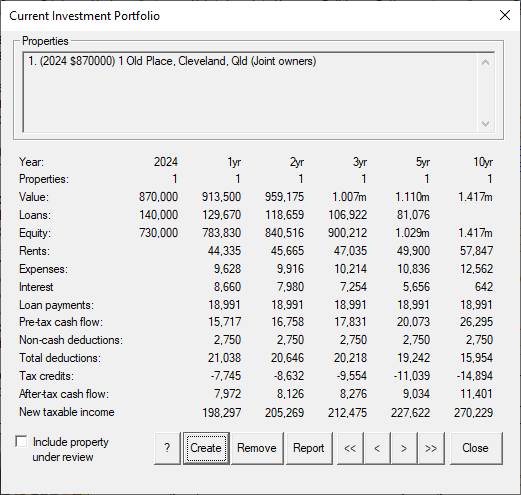

12. Click OK, then open the file “NewPlace” that our couple are now considering to purchase. Given that they already own “OldPlace”, their taxable income should be adjusted accordingly. The best way of doing this is to create an existing portfolio that contains “OldPlace”.

13. Open the Current Investment Portfolio dialog (Investor menu) and click on Create. Choose OldPlace and click Add to add it to your current portfolio. Then click Done.

Note that the portfolio comprises the 1 property (OldPlace) with an equity of $730,000 and that the new taxable income has been updated to 198,297. Click Close to return to the NewPlace spreadsheet and note the change to the Tax credit row.

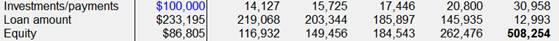

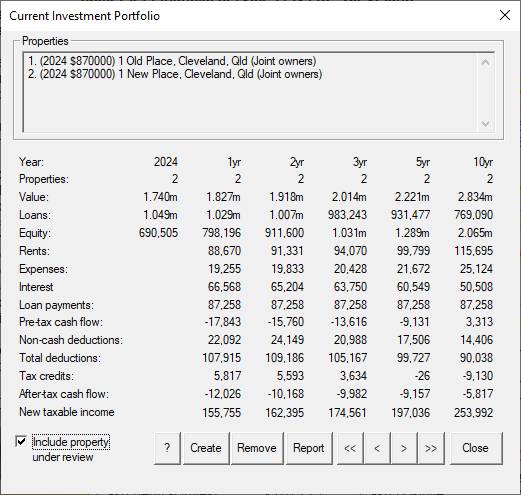

The taxable income has increased to 198,297, the tax credits have increased and the after tax cash flow has decreased accordingly. The answer to the first question is that the cost per week for the second property has dropped from $413 per week to $385 per week.14. To answer the second question, we must go back to the Current Investment Portfolio dialog and click on “Include property under review”.

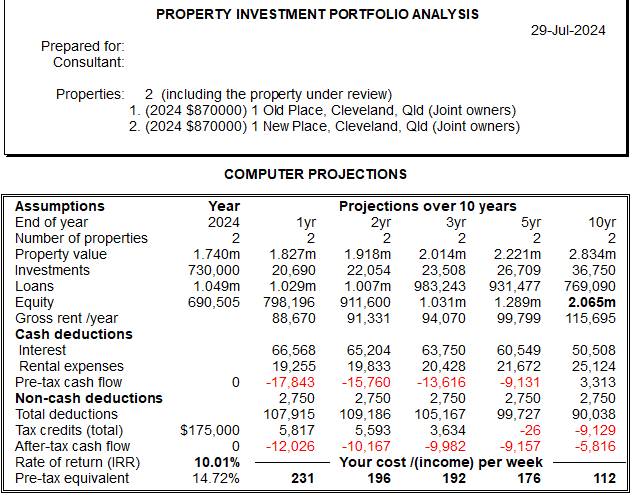

Now click on the Report button to get a cash flow analysis of both properties together.

It shows that with both properties included in the portfolio, the combined cost per week is just $231 per week. Note also that the projected IRR is now 10.01% (up from 7.78% from the “OldPlace” alone).